Self Directed Gold Silver IRA – Custodian Reviews, Convert Retirement Accounts

If you’ve ever watched the Disney movie Aladdin, then you probably recall the villain’s version of the golden rule – that the one who has the gold makes the rules. While intended to be comical, it makes an interesting point: Gold has always been very powerful in our society. The same goes for silver. Now of course we shouldn’t live a life in fear of the powers that be, but rather have a future of security through a self-directed gold and silver IRA, or as it is also better known as the 401k gold IRA rollover which can also include silver, platinum, and palladium.

Below we’ll be getting into the different types of physical ingot bars and coins, along with the benefits, reasons why you should invest now and how you should go about all of it. We’ll also explore the upside potential of both gold and silver and why we might just be living in the most opportune time to be invested in these two particular metals. At the bottom of this article, to make it easier on you, we have selected who in our opinion is the best gold silver IRA custodian. We’ve researched all the gold-silver IRA reviews and feel that they’re the most qualified to convert IRA gold silver or any other retirement accounts for that matter.

The world is gradually becoming a more sinister place economically, with the constant threat of a dollar devaluation, stock market crash, social security, and pension payments being severely underfunded. It’s scary out there, which is why you can’t afford to put all your eggs in one basket anymore. With that in mind, we advise first picking up the high-quality free gold ira kit below, it will really make the difference if you are on the fence about precious metals IRAs…leaving no eggs unturned.

The providers of this investors kit have recently been awarded the most prestigious award in the industry:

The International Bullion Dealer of the Year 2021!

——————————————————————

Benefits of a Self Directed Gold Silver IRA

This type of IRA is highly beneficial as part of an investment portfolio because they have certain tax advantages and allow for investing in more diverse assets. You may not have known that you can own assets other than stocks and bonds, such as precious metals and real estate. While there are restrictions on early withdrawals, this is a great way to save for retirement while increasing your overall earnings during retirement.

Reasons why savvy investors are accumulating gold in their portfolios, include:

- A time-tested hedge against inflation, while at the same time, deflation.

- Has always served as a safe haven during times of global financial and economic strife, wars, and now trade & currency wars.

- A tremendous store of value that only continues to increase throughout the decades.

- Gold offers protection against central bank money printing policies and the continually declining strength of the dollar.

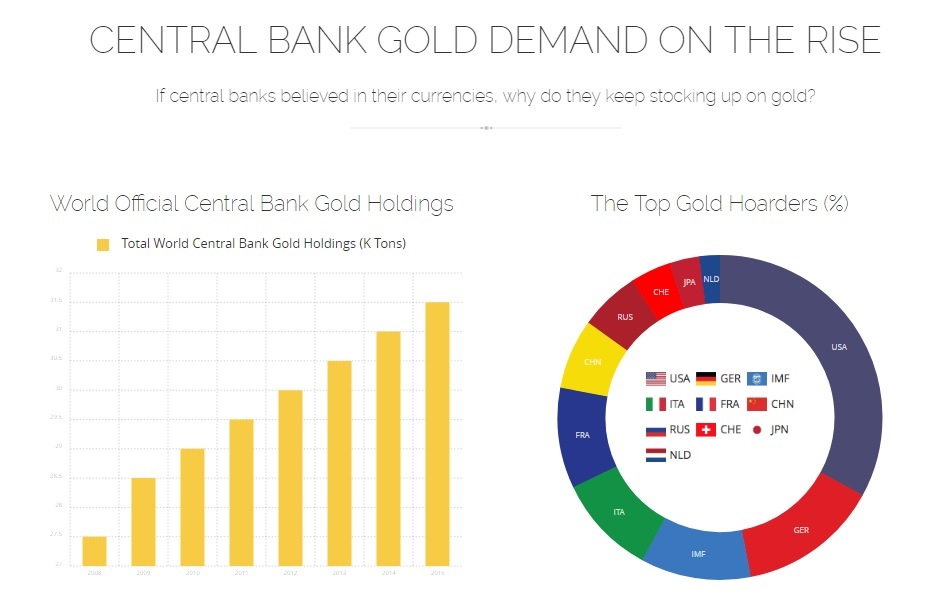

- Constant ever-increasing demand and limited supply. (from the chart below, see who is buying up all the gold at a rapid pace)

- Diversification of portfolio while protecting previously earned retirement funds.

This type of gold acquisition worldwide by governments and top financial institutions is certainly a main factor that may contribute to us seeing new price highs in the not too distant future.

The Other Immense Opportunity: Silver

To see all the reasons why you should also be adding silver to your IRA, have a look at our article below:

Physical Silver Backed IRA – Is Silver a Better Investment Than Gold?

Things to Know: 401k Gold IRA Rollover

The preferred set-up is the self-directed gold IRA. Again this can also include silver. Full control resides with the owner/investor. The individual is in charge of all decisions made and investments selected. This allows more freedom than other types of accounts such as the 401k, making it easier to diversify while allowing for the same limitations when it comes to deposits and withdrawals. You may also opt to have a trustee or custodian hold & handle your investments for you.

Self-directed gold and silver IRAs are allowed to be held simultaneously with multiple others. This is the better choice because a self-directed account makes it easier for you to make decisions on your own about investing in certain types of gold and other precious metals. If you have an account trustee, you’ll have to research suggestions and consider recommendations while making sure that your instructions have been executed correctly for you. Double-checking and following up can be tiring and not knowing if they have your interests in mind, can ultimately take away from your peace of mind.

Note: You must make sure that you are purchasing IRS-approved precious metals.

For a full list of precious metals approved to hold in your IRA (gold, silver, palladium, platinum bullion coins & ingot) click below.

So Why Invest in Gold Now?

Again, there’s never really been a bad time for gold. Not only has gold been a constant in human trade for centuries, today it is still one of the most sought-after commodities with an ever-increasing demand. As the federal government continues to print more money you can avoid the impending hyper-inflation by investing in gold. It often seems to be even stronger when the economy is slow or recovering.

In this chart, you’ll see that gold had made a remarkable all-time high back in 2011-2012 (to $1,800+/oz.) and has since made a pullback during 2013-2015 to opportune buying levels. For the past 3 years consecutively, gold has made a strong, steady comeback and is on the verge of breaking out of the $1365 level.

If this level breaks, we could see another test of the all-time high and perhaps beyond to new record highs. Most financial experts expect big moves within the next few years.

Perhaps this is because precious metals are something tangible, as opposed to things like currency and stocks which really just amount to paper and are considered high-risk. The values of currencies can fluctuate like crazy, whereas gold is particularly stable and accepted the world over. Thus, investing in gold bullion is a logical way to ensure the security of your investments.

How to Invest in a Gold and Silver IRA

There are a number of ways, but one that many have turned to is again, the 401k gold IRA rollover (another phrase for purchasing any IRS-approved precious metals from an existing retirement account). This involves opening an IRA account and then transferring money from a 401(k) or other current retirement accounts mentioned above to purchase the precious metals of choice for your IRA account. You can also directly purchase gold & silver bullion ingot and coins that you can actually physically hold for safekeeping, rather than gold ETFs or gold stocks. In this way, you can get to work securing your retirement through gold investing.

Our top-recommended gold and silver IRA custodian has also been the recipient of the highest honor in the precious metals industry:

International Bullion Dealer of the Year 2021!

It’s not complicated at all to execute a self-directed gold and silver IRA rollover so do not hesitate any longer. Remember that silver, palladium, and platinum are also good options and can be added as valuable assets to your precious metals IRA. Stocks can be unreliable, but precious metals have enjoyed a long history of reliability that predates our modern economic system. A diverse portfolio isn’t complete without an IRA that involves physical gold or other precious metals.

Also, you may read other in-depth gold & silver IRA reviews of our top recommended company here.

We’d love to hear your thoughts, or if you have any questions join the discussion in the comments section below.