Buy Gold with IRA + 5 Benefits of Gold IRA Rollover Investing

Just how easy is it really to buy gold with IRA funds? In other words, executing a gold IRA rollover. With all the benefits that go along with gold IRA investing, İt’s important to know the rules and what to look out for when selecting your precious metals investments. We’ll cover which types of metals are approved by the IRS for IRAs and recommend a top custodian for storing your physical precious metals IRA legally.

Just how easy is it really to buy gold with IRA funds? In other words, executing a gold IRA rollover. With all the benefits that go along with gold IRA investing, İt’s important to know the rules and what to look out for when selecting your precious metals investments. We’ll cover which types of metals are approved by the IRS for IRAs and recommend a top custodian for storing your physical precious metals IRA legally.

Benefits of a Gold IRA

Everyone wishes to find that one investment that will not only give good returns, but at the same time carries minimal risk. You probably have a retirement account or several assets set aside for your post-retirement financial security. Here are only 5 benefits of a gold IRA, but there are many more:

- Almost every type of retirement account can be rolled over into a self-directed gold IRA

- Gold IRA rollovers can be done without any tax penalties or early distribution fees

- You can sell gold holding and reinvest in other assets

- Reduce risk and volatility of your overall retirement portfolio

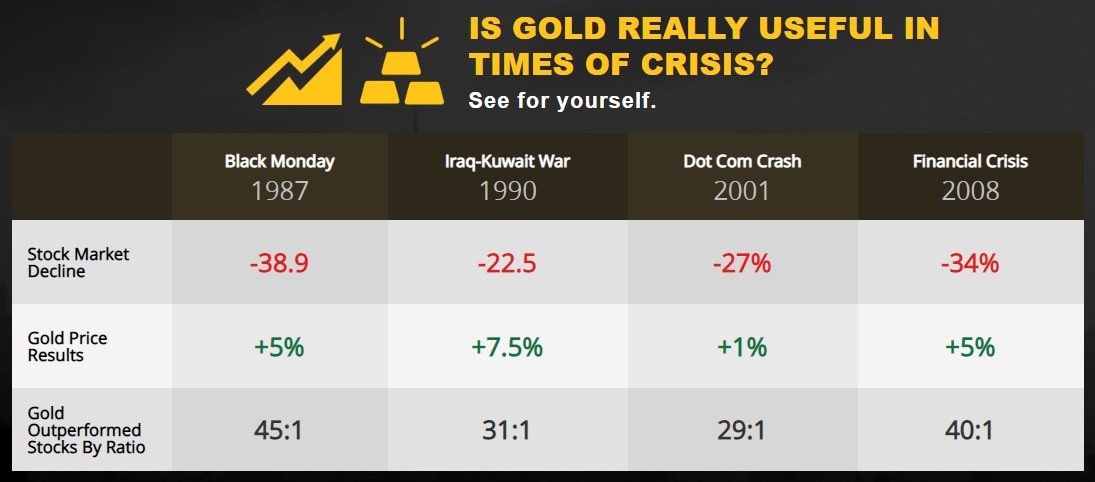

- Must have for wealth protection and diversification. Does well in times of crises (see graphic below)

Your retirement account and assets are a great way of ensuring you have something to fall back on once you retire, however there is an even better, more solid, easy and fast investment; the benefits of a Gold IRA rollover with the added security of physical precious metals using your current retirement accounts to fund it.

IRA Approved Precious Metals

For Gold or Silver IRAs you are able to only hold coins or bullion (click below to find a list of acceptable coins and bullion). But be careful that the following two criteria are met:

- The fineness of the bullion/coin is at a minimum .9950

- The bullion has been manufactured by a COMEX or NYMEX approved refiner

Not every rare and valuable metal can be added into your IRA. The IRS has a list of IRA-acceptable metals, which comprise coins, bullion and bars of gold, platinum, palladium and silver. All IRS-approved metal forms for IRA must contain the actual or higher content of the specified metal’s purity. For a complete list of approved IRA metals forms, kindly visit the IRS site or consult your dealer.

Gold, Silver, Platinum, Copper, Rhodium and Palladium are some of the valuable metals which you can invest in (through direct purchases) but for retirement accounts be careful what you are purchasing, as mentioned above. You need to be aware of the precious metals IRA rules that govern IRA metals ownership and transactions.

Precious Metals Investments

Physical rare metals, unlike paper money, other businesses or physical properties, are rare and durable. Their rarity greatly minimizes their inflation and loss/ reduction of purchasing power. Their durability and almost-indestructible nature ensure they maintain their quality over time as rust, water and fire, among other elements, rarely affects them.

Again, political instabilities, wars and other calamities, which affect a region’s economy and consequently the performance and worth of other assets/ investments, do not affect precious metals prices negatively because the metals are a global currency; not a reserve of one region.

Here’s a graphic that shows how gold performs in times of crisis:

Owning and investing in these metals is easy, cost-effective and fast, especially if you work with a reputable dealer. You can purchase rare metals products (coins, bullion, and other items) and store them in your home or with a custodian. You can, also, invest the metal forms in a individual retirement account serviced by a custodian.

Direct Purchase Vs. IRA (Individual Retirement Account)

As implied by the word, direct purchases are as easy as walking into a dealer’s shop and buying the metal forms you want, or ordering via other dealer-provided platforms, and having the dealer send the metals to you. You can also invest a variety of metal forms in your IRA. If you do not have an IRA, you will have to open one with a reputable gold IRA custodian, authorize funds from that account to purchase the rare metals of your choice and deposit the metals with an IRS-approved custodian.

If you already have an IRA, you can transfer funds from the same account to purchase valuable metals or you can convert one account to an IRA backed by gold through the rollover process. Either way, a reputable dealer can guide you through the processes to ensure you benefit maximally and not incur unnecessary penalties/ fees from the IRS (Internal Revenue Service).

Custodians for Private Metals Storage vs. IRA Services Metals Storage

Just like banks store your money, there are custodians who can store your metals at a fee. You can deposit your direct purchase-metals’ items (coins, bullion, etc.) with these custodians, for safe keeping, or you can keep the metals in your own home. IRA metals, on the other hand, have different storage policy. The IRS requires that all IRA metals be stored with an-IRS approved third-party custodian.

Our Top Recommended Gold IRA Custodian

There are hundreds of companies that can aid your acquisition and investment of the above precious metals. Choosing the right one can, however, be a challenge given their varying fees, terms of service, products and customer support among other factors.

You can visit their official website here at: RegalAssets

Please also read our full Regal Assets company review as well.

For years, and certainly our favorite precious metals company this year was also chosen as “Bullion Dealer of the Year 2018”. We have evaluated a majority of the companies out there, and RA are simply our top rated recommendation hands down. Here’s why…

For years, and certainly our favorite precious metals company this year was also chosen as “Bullion Dealer of the Year 2018”. We have evaluated a majority of the companies out there, and RA are simply our top rated recommendation hands down. Here’s why…

- Reason 1: All fees are waived for the first year. (account set-up, transfer, rollover, admin and storage)

- Reason 2: They are the fastest in the business. They pride themselves on keeping you informed the whole way through (quick account set-up, funds transfer, payments and metals delivery)

- Reason 3: Authenticity/ credibility (availability of information on multiple sites, accreditation and affiliations with business authorities), customer support (availability, professional knowledge and skills, friendliness/ willingness), customer reviews, buy back policies and money back guarantee comprise some of the criteria you can use to settle on this gold company.

Regal Assets (RA) has ample information online if you’re looking to buy gold with IRA funds, competitive spot prices, reasonable fees, fast processes, professional and helpful customer support, excellent ratings on many websites (BBB, BCA, TrustLink, etc.), affiliations with trusted institutions in the rare metals industry, and awards, are just some of the benefits of a Gold IRA.