Buy Physical Gold with 401k

Applaud yourself for realizing how truly important it is to diversify into precious metals now more than ever, especially gold, and for taking action to secure your hard-earned retirement savings.

For those asking, “Can I buy gold with my 401k?”: Yes, you most certainly can buy gold with your 401k. And luckily for you its a very quick and easy process to purchase physical gold since you already have an established 401k. You’ll be doing this through a process called the “rollover”.

How to Buy Gold with 401k

If you want to buy physical gold with your 401k, contact your current plan administrator (or employer HR dept.) and request a withdrawal. Decide on an amount to cash out; the minimum to buy gold for a retirement account is $10,000. Most of the time they will mail you a check. In the meantime, set up a new Individual Retirement Account (IRA) with a trusted gold ira company. When you receive the distribution check or transfer, you’ll then deposit it into this new IRA account within 60 days to preserve the tax-deferred status.

* Be careful not to overlook the 60-day time period allotted or you’ll be liable for early withdrawal penalties and capital gains tax.

Buying Physical Gold with Your 401k

Once funds from your 401k have been rolled over from your old provider into your new ‘Gold IRA’ account, your account executive (custodian) will get a hold of you to go over your options regarding which precious metals you’re legally allowed to purchase for your retirement plan. You (the client) will then tell your representative exactly which coins or bullion you’d like to buy and the price should be locked in right at that instant.

* Take note of the price, perhaps make a phone recording or request one, to make sure its the price you agreed to. Remember to look at your statement later on to cross-check this.

After the client buys the precious metals for their IRA, the custodian will have them shipped to the IRS approved storage facility within 7 days. (The company we recommend uses fully-insured Brinks vaults and is the only custodian in the industry to ship your bullion so quickly. Other companies take many more weeks). Once the metals arrive at Brinks, you’ll be notified by your custodian and can visit the vaults in person, or track them and view them online 24/7.

IRA Approved Gold

NOTE: The physical metals that you purchase for your IRA must be IRS approved. Click below for a full list of IRA approved gold, silver, palladium, and platinum bullion and coins.

Now, just because a coin is gold doesn’t mean it’s good for investment. There are different kinds of coins and bullion that are actually investment grade. Stay away from collectible coins and check the purity, which is the most important factor to take into consideration. Collectibles and their prices are based on subjective factors and are not tied with the highs and lows of the market prices.

This is why we always recommend having a custodian assist in the selection process and provide guidance along with the proper paperwork to complete the transaction for your gold IRA rollover.

Now that you’re ready, this means you’ll be rolling over funds from your 401k into an IRA with which you’ll be purchasing physical gold bullion (in the form of bars and/or coins) to be stored legally with a registered custodian.

Remember, there’s a big difference between the physical form of gold (coins, bullion) and paper form (gold stocks, index funds, ETF’s, etc.). We want to stay as far away from paper assets and fiat as possible when it comes to our retirement planning. Physical gold that you can actually hold in your hands (a safe or store with a custodian) is the way to go for all sorts of reasons which we’ll get into below.

Rollover 401k to Gold IRA

There are several ways to buy gold. You can buy gold offline or online, although the latter has proved to be more convenient especially if you don’t have a storage vault to keep your reserves at home. For this, a full-service dealer and custodian can be arranged. Most people prefer to buy gold coins because of its price and portability.

You can buy gold coins from gold exchange services or coin dealers. As mentioned above, the best option is to open an Individual Retirement Account (IRA) and purchase gold through this IRA. Rolling over funds in this way is tax-free and is becoming quite popular if you have funds in your 401(k) to roll over and invest in gold, silver, platinum, and palladium.

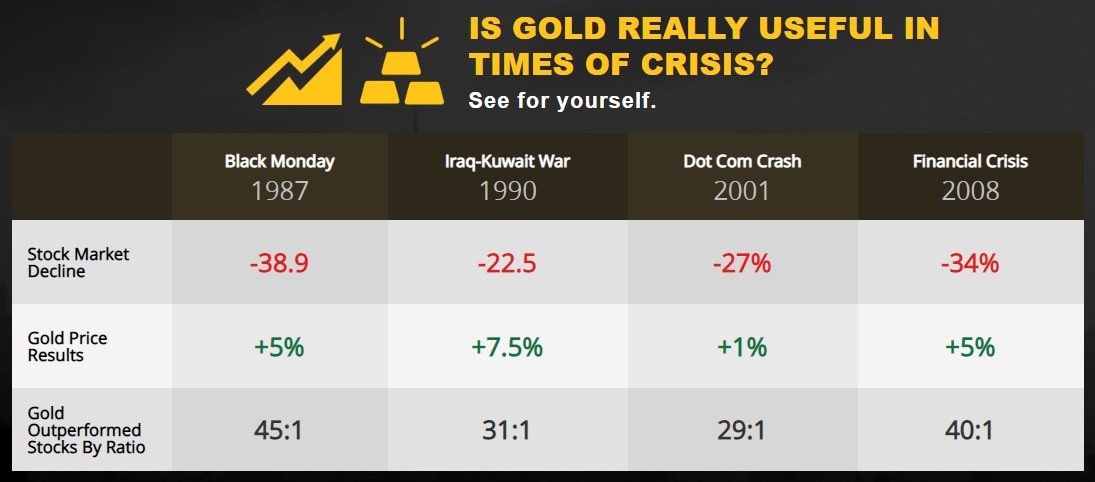

Check out this chart that shows gold’s performance in times of crises (silver is similar):

Buy Physical Gold IRA

Also, as a reminder, here are some of the top reasons why investing gold in an IRA is a must and we’ll point you in the right direction by recommending our top-ranked gold IRA company below (dealer and custodian).

- Gold is a great hedge against both inflation and deflationary economies.

- Gold does not correlate with the dollar and is a time tested hedge against a declining dollar.

- Protection against quantitative easing (QE), money printing policies, and austerity programs.

- The ultimate safe haven in times of financial and banking crises, geopolitical and economic turmoil.

- Gold has a limited supply and there is ever-increasing demand.

- It is perhaps the greatest store of value.

- One of the best ways to diversify and protect any portfolio, especially for retirement.

** Our current and top recommended gold IRA company for the past 7 years straight has just won the most prestigious award in the industry again: The International Bullion Dealer of the Year 2020!

So if you’re serious about investing gold in an IRA, then visit them below and order a FREE gold IRA investing kit or if you’d like to get professional assistance right away you may talk to one of their reps

((They pride themselves on NOT being pushy salespeople – so you don’t have to worry about feeling pressured)).

This is the Year of the Comeback for Gold

Gold had declined substantially in the year 2000 to around $400 an ounce. Then for a decade straight, the price has been steadily increasing non-stop. In 2011, after reaching all-time highs of close to $2,100/oz. gold maintained this price level for almost another decade. Which is why gold is categorized as a ‘store of value’.

Gold had declined substantially in the year 2000 to around $400 an ounce. Then for a decade straight, the price has been steadily increasing non-stop. In 2011, after reaching all-time highs of close to $2,100/oz. gold maintained this price level for almost another decade. Which is why gold is categorized as a ‘store of value’.

Now here we are at the end of 2020 still maintaining this price level, about to go higher.

Since 2015 gold has been back in an upward trend on a steady rise. Now why it’s important to take action now is because of the difference from previous years regarding the fact that there’s a much bigger problem brewing in the world. It is completely plausible that gold prices will reach new highs again (especially in the next couple years), in the not too distant future due to the increased risk of default among many countries and states.

Budget deficits, investment downgrades by rating agencies could all spill over and create a toxic economic environment once again.

Keeping the Presses Running Doesn’t Help

No doubt governments defaulting on payments, whether in bonds or T-bills, could have devastating effects and would wreak havoc in the financial markets. We have seen a glimpse into this from the 2008 crises and even more recently with conflicting monetary policy. Constantly printing more money only exacerbates the situation for the already super weak American dollar. And if anything out of the ordinary happens, it could devalue its reserve currency status and a further decrease in value exponentially.

We are definitely on shaky new ground and entering into a new world order when it comes to economics and finance. So it seems that traditional ways of investing might not be the best way to go anymore. Diversifying makes sense more than it ever did. The commodities that remain valuable in everyone’s eyes and most commonly traded, which every country recognizes as an asset, are precious metals.

We are definitely on shaky new ground and entering into a new world order when it comes to economics and finance. So it seems that traditional ways of investing might not be the best way to go anymore. Diversifying makes sense more than it ever did. The commodities that remain valuable in everyone’s eyes and most commonly traded, which every country recognizes as an asset, are precious metals.

Physical Gold or Pseudo Gold?

When comparing the investment of physical gold to the “pseudo” or paper gold funds (stocks, indexes, or exchange-traded funds), we can see that across the board hot commodities like gold prove to be a more stable investment and may offer a fantastic return in the future (if bought now). Its average value likely will continue to increase steadily for years to come. Investing in gold bullion is a good investment primarily because as the cost of production rises, so does the value of gold in contrast to its supply.

Physical gold values in general are always perceived to rise continuously into the future, especially when looking back to the past few decades as a performance indicator. It is preferable to invest in gold that you can actually hold physically in a safe. Because if the stock market crashes or the dollar goes into a deep decline, paper or digital money values could become practically worthless. Now I know I’m being extreme, but it has happened before throughout history. Think about that.

If you wish to protect your wealth, consider buying actual physical gold to be placed in your IRA instead of investing in shaky currencies or even the stock market. The stock market has reached unheard-of highs and at these levels has now taken on “bubble” like characteristics. Remember, when consumer optimism is at extremes like this, we actually start to see a sustained decline. This has begun to happen at the end of 2018. At the same time, gold is sitting on strong long-term support and psychological level at $1,200+/oz. and looks poised for a bounce and possibly a full-on recovery.

Although purchasing gold can be considered a luxury, the bullion market makes it easier for smaller investors to afford to have their money backed by this commodity. Gold bullion and coins are no doubt more portable and cost less than the bars of gold you’re used to seeing. Thinking strictly worst-case scenario: No matter where in the world you are, gold is considered a precious metal and even if paper money were to become worthless, history shows that there will always be someone willing to exchange goods or services with your gold.

Although purchasing gold can be considered a luxury, the bullion market makes it easier for smaller investors to afford to have their money backed by this commodity. Gold bullion and coins are no doubt more portable and cost less than the bars of gold you’re used to seeing. Thinking strictly worst-case scenario: No matter where in the world you are, gold is considered a precious metal and even if paper money were to become worthless, history shows that there will always be someone willing to exchange goods or services with your gold.

Not everyone can afford to buy huge amounts of gold obviously, so investing in gold bullion is more convenient for most people. You can invest in small amounts of bullion or coins over time while you’re trying to grow your savings for retirement.

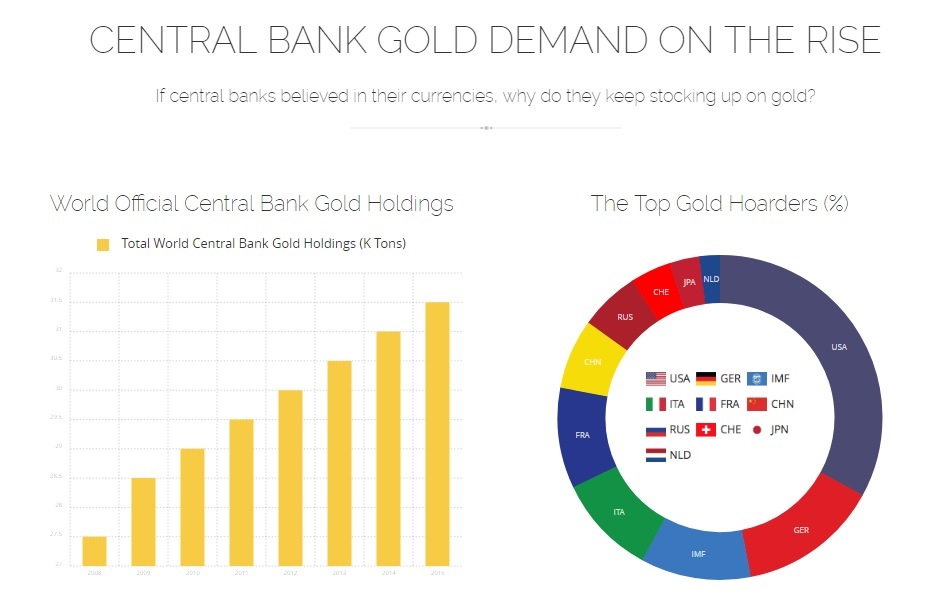

Gold bullion is held in high quantities by the world’s central banks as reserves (like insurance, as a hedge and safety net from inflation, improving their asset base and also holding them for their investors. Gold continues to be one of the strongest forces that drive economies for several governments, including China and India. It will continue to thrive in the foreseeable future, so to align with gold would be a smart idea.

There are wide uses of gold aside from jewelry, and this allows gold demand to consistently remain high and continue to rise, especially due to its’s limited supply. Gold is used in the electronics industry and is integral for other technological breakthroughs within the science and medical industries, which are also seeing increasing demand.

Investing In a Gold IRA

Perhaps this is the year when you’ve finally decided to take action after seriously considering adding gold and/or silver to your retirement portfolio or purchasing physical precious metals for safekeeping. It’s a big decision and one that must be made sooner than later.

With the world economy teetering on disaster and the stock market plunging once again, prudent investors are diversifying good portions of their retirement portfolios into gold and silver.

If you’ve been contemplating making a move for a while or have recently heard that rolling over your 401k (in full or partially) or using current IRA funds to transfer into a physical gold IRA is a great way to protect your investments; there couldn’t be a better time to move forward. Since the latest financial crises, it’s become a necessity to protect your retirement earnings and savings for the long term.

Our Top Recommendation

If you wish to buy physical gold with your 401k funds, in other words, rollover your 401k into a gold IRA or an IRA containing other precious metals, such as silver; go ahead and also read this review of our top-rated gold IRA company here.

- Receive a free kit explaining everything in detail and speak to their courteous experts who’ll answer every question you might have on how to invest in a gold IRA.

They’re also one of the most recognized and reputable companies in the industry that will help in guiding you through the whole entire process.

After taking action today, please feel free to share your experience with us in the comments section below. We’d love to hear from you.