Fidelity IRA Rollover 401k – Roth Accounts Reviews Gold Fund

For a company that has been around for over 70 years, offering services that run the gamut; from mutual funds, ETFs, CDs, stocks & bonds, life insurance, annuities, etc. – an IRA is nothing new to them. They’ve certainly been very active in the retirement planning aspect of financial services managing 401(k), Roth, and gold fund type investment options of all kinds.

IMPORTANT: If you are a first time investor and looking to rollover funds into an IRA, especially for the purchase of precious metals, it is best to go with a company that specializes in this type of rollover.

Our current top rated precious metals dealer and custodian has been selected as “Bullion Dealer of the Year 2018”.

So when looking for Fidelity IRA rollover reviews, the question now really becomes how high are their fees and how good is their customer service. Let’s take a look at what is revolving around this huge company heading into 2019.

You know how the saying goes: Jack of all trades, master of none.

By Fidelity trying to do too many things at once, it seems to have reflected poorly on its ratings, as you’ll see.

Fidelity IRA Rollover Reviews

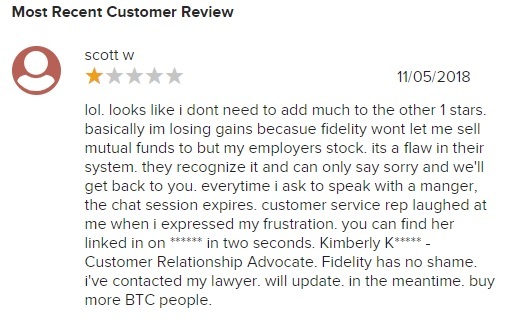

As old and as large as Fidelity is, they’re bound to get mixed reviews. Having a look at a more recent snap shot within the past three years or so reveals a lot about the company overall. How good or bad can it really be and what are people saying…here is one example:

Fidelity Gold IRA Rollover Reviews

Now because of the range of services offered is so broad there are a lot of different complaints and reviews, so it is hard to pin them down to just precious metals IRA related issues. However, when the vast majority of complaints stem from the customer service side of things, you could assume that it affects their IRA department as well.

Although the Better Business Bureau (BBB) is a good source generally for checking whether a company or organization is trustworthy, you can sometimes get a feel for current customer satisfaction.

For example, the BBB has given Fidelity Investments:

- a rating of C- (because 38 of the complaints filed have not been resolved)

- 1-star based on 74 customer reviews (this stands out negatively)

- the company has not been accredited by the BBB

Keep in mind clients that are happy and whose transactions have gone smoothly, rarely do seek to leave positive reviews. Most of the time disgruntled clients do the extra leg work and go out of their way to leave a negative review out of spite. They put in the effort if they feel they have been wronged and have not been able to get an issue resolved or a refund through normal communication lines.

Fidelity Investments Complaints

As of December, 27 2018:

- 287 complaints have been resolved and closed in the past 3 years

- 93 complaints have been resolved and closed in the past 12 months

- 38 unresolved complaints

At first glance this does not look good. Yet for a company of this size, with it’s sheer amount of customers, this amount of complaints could be viewed as normal or even low. Now typically we would like to see positive reviews sprinkled in here and there keeping the rating close to at least 4 stars. But they are nowhere to been seen, which raises some concern.

Complaints are on the high side, while positive review are on the low side, which is not a favorable combination. Their reviews could be viewed as conflicting because at the same time Fidelity has closed 93 complaints resolved within the last 12 months of writing this. Now the reason this might be interpreted on the good side is that the complaints largely have been resolved with the BBB’s assistance.

This shows that at least Fidelity is putting forth the effort to respond and make it right with the client. They do care about their reputation and keeping their clients happy whenever possible. For the volume of customers they handle day in and day out, this is an important positive attribute. Within the investment community it is known that Fidelity is well versed in guiding investors around the world, giving sought after recommendations and overall they can be trusted to do the right thing with your savings. It does have a good reputation among many current and past customers which is evident with millions of dollars invested in their funds daily.

Fidelity Investments Positive Reviews

- There are only two, 5-star reviews in the past two years

- Zero 4-star reviews

- There are only three, 3-star reviews over the past two years

Now if we go back to total the complaints on the Better Business Bureau (BBB) site within the past three years, we can see there’s are 287 closed complaints as of writing this. This can be interpreted as a positive thing if in fact those were resolved to the clients satisfaction. Most of which are problems with the products, service, billing, delivery; then there’s the advertising and sales issues as well.

You can read people’s experiences directly at the BBB site if you wish, I won’t get into any more details here. Also, have a look at other consumer advocacy group sites that are sometimes used to research a company’s reliability, which include the Business Consumer Agency (BCA), ScamBook, RipOff Report, and Complaints Board to name a few. We feel the BBB provided enough information and actual reviews to see the overall picture.

Summary

While researching further if you stumble upon complaints make sure they are coming from real customers. The more detailed the better. Loyal customers will leave positive reviews as well, so look out for those to get a fair view.

Some general complaints people have with precious metals dealers are that the client will stop receiving their statements. When you decide and are with a precious metals company and have rolled over into an IRA make sure to monitor your statements monthly.

Customers generally complain about companies charging hefty fees. This is something you can avoid upfront by having an idea what the precious metals current spot prices are and by asking for a full list of fees in writing before sending your money.

Our Current Top Recommended IRA Company

Especially since precious metals IRAs are a more recent and delicate matter you may prefer to take your business to a company who can dedicate their full attention to your needs. Perhaps one that focuses just on precious metals IRAs.

To get a better idea what fees are normal for a company to be charging here is a good example.

Sharing your comments regarding Fidelity IRA rollover reviews below, negative or positive, is appreciated. Thank you for helping others.