How to Convert an IRA to Gold – What is the BEST Way…

With so much economic turmoil surrounding most modern markets, investors are constantly looking for the best way to secure their financial futures. So the question eventually arises…

How to Convert an IRA to Gold ?

The problem, however, is that most investment instruments are too heavily based in paper currency, which is subject to a variety of problems. Economic collapse, inflation, shifting relations between different countries, all of these things can devalue the paper dollar, and all investments tied to it. With so many assets and markets tied to paper currency, investors may feel as though they have nowhere to turn to secure their financial futures.

So what it the best way to get around this?

Converting an IRA (either transferring funds in your IRA to purchase precious metals or rolling over funds from a 401k) to gold is one of the only reliable ways to secure your financial future. Buying physical gold will ensure that you have a reliable hedge against inflation. It is a commodity that will almost never lose value because of how much historical and intrinsic worth is built in. An investment in gold can act as a guarantee that your finances will be safe for as long as you hold onto the gold. However…

There is a RIGHT way and a wrong way to purchase this commodity.

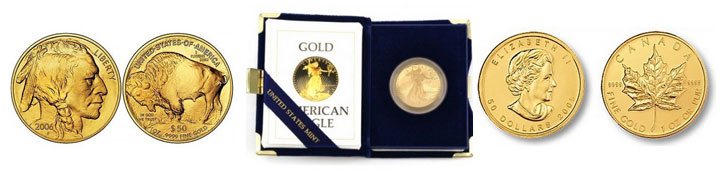

Avoid investing in gold jewelry and numismatic coins because a lot of the value is derived from a variety of subjective factors, such as collecting value or craftsmanship. Put simply, these investments are not worth their weight in gold. Similarly, it is crucial to stay away from gold ETFs and gold in the forex market because of their ties to paper currency. Gold that you purchase should look like these examples below.

Purchase only IRS approved bullion and coins through a precious metals IRA, complete with a reliable custodian, as this is the only way for you to avoid some of the taxing pitfalls that come with investing in precious metals. It is also possible to purchase gold bullion and coins directly, without an IRA, but a gold IRA rollover may be much easier for beginning investors who already have a 401k.

Performing a rollover 401k into precious metals depends on your financial situation. If your 401k is from a company that you no longer work with, you can roll the funds over to a standard IRA. From that point, you can simply buy gold or silver after selecting an IRA custodian, who will help you with the process.

If you work with the company still, you can perform an in service distribution, which distributes your funds into self directed gold backed IRA. If the company does not feature such a service, you may have to contact your company and request a formal opportunity for gold IRA investing through your 401k.

You may choose to purchase any variety of approved metals as well, such as silver and platinum, in addition to gold. One important thing to remember is that when you start a rollover, you must complete it within sixty days. Most regulations revolve around storage and purchasing, and all fees may vary depending on who you perform the rollover with. The IRS does not allow your custodian to store the gold themselves. It is crucial for it to be held at an IRS approved depository.

Our top recommended company Our top recommended company can be an excellent group to work with for your IRA rollover, as they can provide you with reliable rollover kits and custodians for all of your gold needs.

We have also done a full Goldco review so you can see all the reasons why they remain our top choice.

If you have more specific questions you can call the friendly experts at Regal Assets. They will not hassle you and we would like to emphasize that they are not pushy salesman. They are there to educate you on the process and it’s the quickest, surest way to get the info you need from a reputable source.

* Or click below to get your free packet. They will call you just to confirm your address before sending out the hard copies.