Physical Gold in an IRA – The Best Way

I’m sure by now you do not need any more convincing on why you should own physical gold in an IRA account. Some reasons that sound investors choose this asset class are because of its store of value and safe haven status, especially in times of economic unrest.

I’m sure by now you do not need any more convincing on why you should own physical gold in an IRA account. Some reasons that sound investors choose this asset class are because of its store of value and safe haven status, especially in times of economic unrest.

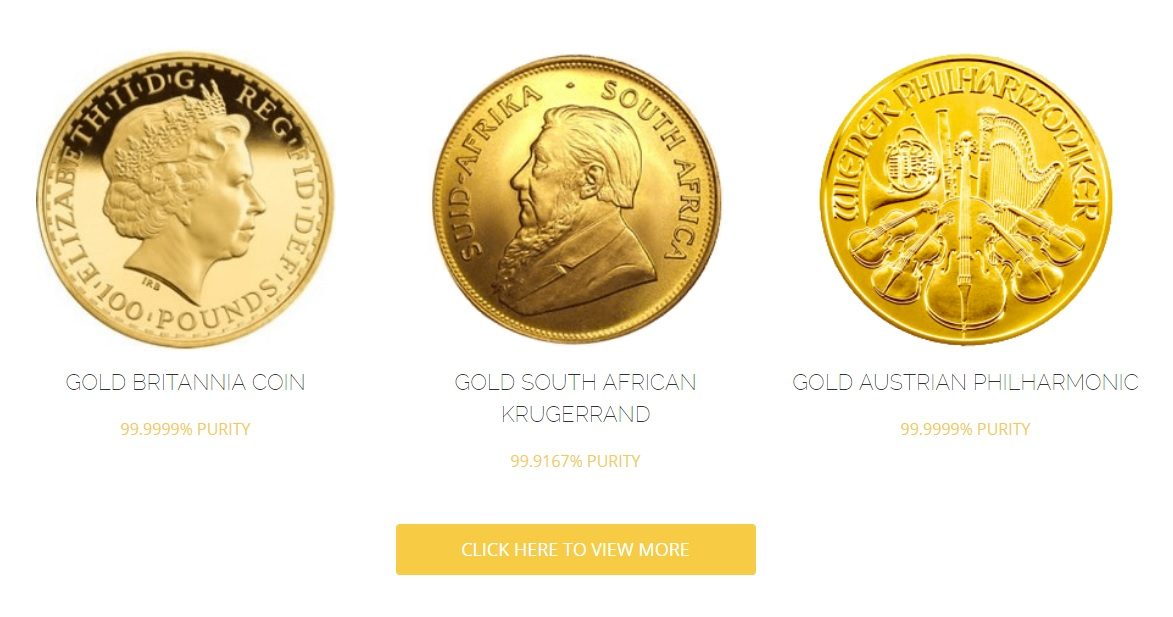

And by gold we do mean real gold bullion & coins (IRS approved) that you can actually touch. The best thing you can do for your current portfolio is hedge against inflation and deflation at the same time by rolling over funds (partially or fully) to a gold IRA. So let’s get right into what you may or may not know and the best way to start getting diversified …

Monetary (paper) Gold vs. Physical (real) Gold

Purchasing gold funds, gold SPDR ETFs, gold related stocks or even buying gold through the foreign exchange markets are not recommended ways of investing in gold, simply due to the fact that these are monetary forms of investing. This means they are all tied to “paper” money, which is what you NEED to avoid.

There’s a world of a difference when comparing this to owning real physical gold that you can hold in your hands and put in your safe (or keep with a custodian).

Reasons for investing in gold in the first place, are to get away from the risks involved with global economic turmoil, continuing dollar devaluation or other currencies collapsing, as well as the stock markets and banks vulnerability. In other words, the monetary system.

Basically, anything that’s printed on paper, whether it be actual money or stock certificates, is at risk and can wind up being practically worthless in severe cases, and cannot be ruled out as a possibility because this has happened in the past.

A Real Life Example

Let’s walk through a hypothetical situation and say you buy gold related assets through a gold index fund or a gold related stock. This might be something like a gold mining company for example.

If and when the stock market crashes, the value of your gold related investment will also decline rapidly because the stock market as a whole will be in a free-fall.

If and when the stock market crashes, the value of your gold related investment will also decline rapidly because the stock market as a whole will be in a free-fall.

In this scenario however, actual gold (in it’s pure physical form) will be heading the opposite direction, going straight up gaining in value throughout this same crisis, because gold is a safe haven asset and whenever there is fear in financial markets everyone seeks gold as protection.

Gold has always been a safe haven hard asset and highly sought after commodity all around the world since the beginning of civilization no matter what the financial situation has been. Because of its limited supply and increasing demand through out these past two financial crises, gold is no being sought after more and more for its protection against the declining value of the dollar and hawkish money printing policies.

When there is economic instability historically people buy gold because it is a true asset that holds its value in weight. Increasing demand and the scarcity of supply continues to make gold the most attractive long-term investment in the new world, and even much more so since the 2008 financial recession.

How Do I Start a Gold IRA the Right Way?

You’ll first need to open a self-directed IRA with a trustworthy custodian. In some cases, the gold broker or dealer not only sells you the gold at the best market price but also serves as your gold IRA custodian. One such custodian (below) that provides all of these services under one roof, is also our current top recommended physical gold IRA company and has been for 5 years straight.

We’ve done extensive research in the field and believe they are the most reputable still, which is why we are continuing to recommend them again this year – all due to their highest overall customer service ranking and quality of service. Plus by offering everything you need in one place makes them stand out above their competition.

They’ve also been selected as the International Bullion Dealer of the Year 2018.

* NOTE: YOU MUST MAKE SURE YOU ARE PURCHASING ONLY IRS APPROVED PRECIOUS METALS. (Click below to see the full list of precious metals (bullion & coins) that are eligible for holding in your IRA).

3 Questions You Should Ask When Selecting a Gold IRA Company

– Do they offer segregated storage for both Gold and Silver? You do not want co-mingled storage.

– Do they have a scaled fee structure? Meaning as your account grows in value, do do the fees.

– Do they have fast processing times? Transfers in less than 48 business hours & shipping within 7 business days.

For the above following reasons we suggest you give them a try and direct all of your questions to them by calling 1-855-712-2993. They’re known for going above and beyond with educating you and making you feel comfortable before investing. There is no pressure selling with them, another reason they get our praise.

They’ll be providing you with the self-directed IRA paperwork and will handle the necessary processing for you. They also provide storage services if you do not want to take custody of the precious metals yourself.

If you would like to read more information, we’ve also done a full review of our #1 recommended company here.