Rollover 401k Into Gold IRA – Tax Free, No Fees

Perhaps you haven’t heard but there is a trend of many people fleeing the equity markets for a much more secure place to put their money. That place would be the safety and comfort of actual tangible gold coins and gold bars. For some to…

Rollover 401k into Gold IRA

Rollover 401k into Gold IRA

…may seem to be a bit of over-preparedness, (“prepper” madness) but the logic behind it is sound. Let’s recall the economic panic which began in 2008 and is still being felt today. It could easily happen again and be even worse next time around.

Just think about it for a minute. The rising debt of the United States is getting out of hand. Soon, the debt that each person “owes” will not be covered by today’s taxes. That means eventually the United States will not be able to borrow money to pay its bills. Now, if that should happen the full faith and credit of the United States will be null and void and with that the value of each dollar.

Now, there are those out there that will invest all of their money into these tangible assets and that is fine. However, it is wise to always keep a diversified portfolio; after all, no one can really predict the future.

Where should you buy Gold bullion?

Now, when people read that they need to invest in Gold and other precious metals, they typically think of buying collector coins or jewelry. That is a really bad idea. First of all, those are not really investments but just fancy items you can store in your home. If you should choose to keep all of your wealth in jewelry and numismatic coins then you are in for a rude awakening in the future.

Buying anything that can be stolen easily is just not an investment. You may even have to insure these purchases and that can drain your monthly budget, making it an ongoing expense. Also, when you go to sell these items back, you’d be lucky to get 10 cents on the dollar. Anything that can be stolen, burned, or lost is just unwise.

So then what is the alternative?

Well as it turns out in 1997 Bill Clinton signed into law a bill that made it possible for any American to buy gold, silver, and other precious metals for the IRA funds. These special funds are monitored by the IRS and as such have a degree of safety and certainty that other investments cannot compare. No to mention, that pure gold or other precious metals are all globally accepted.

Bullion is truly the way to go!

Bullion coins are recognized worldwide for their value. In fact, the value of these precious metals is traded each second of each day and is monitored throughout the world. That means no matter where you go you can buy items of need with your precious metals.

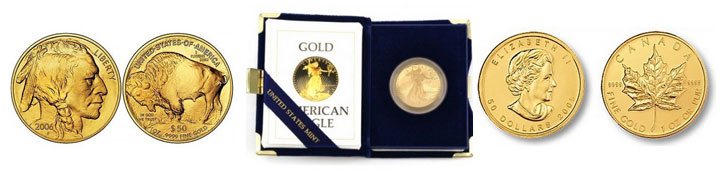

Only IRS approved gold coins can be placed into the IRA so you should be aware of what you are buying beforehand. If you mistakenly buy a numismatic coin then that will be simply money wasted.

*click the image below for a list of all the coins that are approved for your IRA.

Basically, the things you need to be aware of are:

– The purity of the coins should be 99.99% and from mints approved by the IRS.

To avoid any difficulties in the future it may be best to just stick with United States issued coins and bars, after all, it is highly doubtful that these coins will be forbidden in any precious metal IRA fund based in the United States.

– A gold backed IRA fund has several tax benefits.

First of all, you can withdraw your money tax free when you retire. That means you will have the benefits of a Roth IRA but the security of a precious metal backed account. It truly is the best of both worlds.

Why pay taxes on future retirement income?

It really doesn’t make any sense. Taxes have historically increased over the generations. That means that it is highly likely you will be paying more in taxes as you retire then you do today. If you can pay less in taxes that means you can make your retirement last longer.

Now you will probably want to start by opening up an IRA fund using a custodian service. These people know what to do and understand all of the processes involved. Trust their knowledge and experience and understand that they have the experience to get this job done quickly. All you really have to worry about is just filling out some paperwork.

Can you buy Bullion coins without using an IRA?

There is really nothing stopping you from buying gold coins and bars that are not held by a custodian for your IRA fund. You can certainly take possession of these coins but there is very little chance that these coins can later be placed into your IRA should you choose to change your mind, that simply is against the rules.

One of the benefits of buying these coins and bars is that it is very easy to sell them at any time. The recognized value is the spot price of gold and that is a number that is displayed on many numerous websites. Any reputable gold dealer should be able to buy these coins with no issues, after all they are legal tender.

The price of gold and silver is fairly low at the moment this article was written (end of 2014). That means it is an opportune time to buy gold at these historic lows, the more you can buy with your money the more you will have gained in the future.

Gold prices are only set to increase over the coming decades. The reasons for that are numerous and really cannot be covered in the scope of this article. However, what can be said is that India and China are large consumer’s of these precious metals and the reason for that has nothing to do with the stability of fiat currencies.

*Our current top recommended company is not only a precious metals dealer but also a custodian. With Regal Assets all your needs are under one roof. They are waiving all fees for an entire year ! They received our highest rating based on client satisfaction.*

We have done a full company review of them here: Regal Assets Review

If you are interested in learning more details about the process, please feel free to give Regal Assets a call at the number below or click below for their official website:

You can ask their representatives all the questions you’d like, they take pride in helping you understand the whole process. They are not pushy salespeople. There is no obligation and nothing is required of you. Think of them as expert advisors.

Or if you’d feel more comfortable looking through some more literature, we are recommending that you request a FREE hard-copy of these tremendously helpful precious metals investing materials (they will call you to verify your address):

*CLICK IMAGE*